What is Mobikwik ZIP: A Flexible Digital Credit Line

In the rapidly evolving world of digital finance, convenience and flexibility are key. Mobikwik, a leading digital wallet and financial services platform in India, has introduced a game-changer called “Mobikwik Zip.” But what exactly is Mobikwik Zip, and how does it revolutionize the way we manage our finances? In this article, we’ll delve into the world of Mobikwik Zip, exploring its features, benefits, and how it can simplify your financial transactions.

What is Mobikwik Zip?

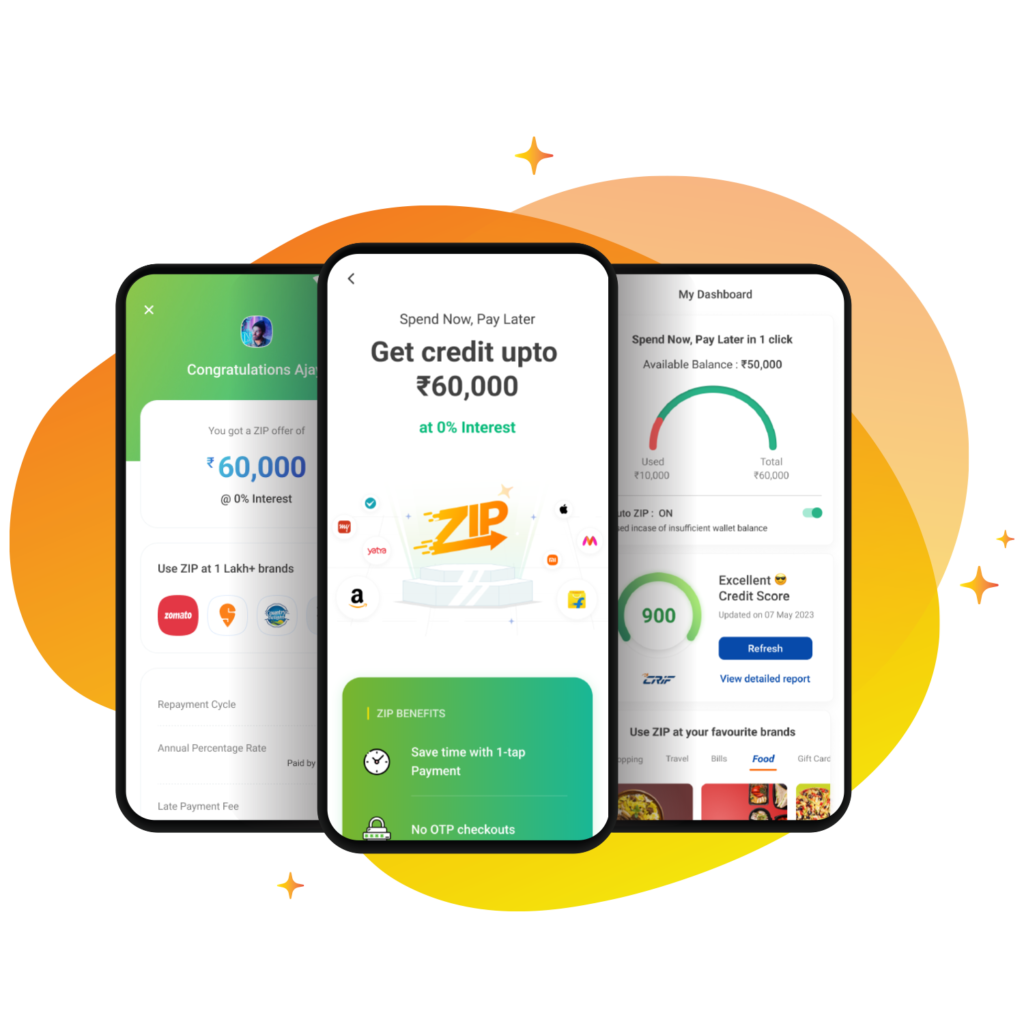

Mobikwik Zip is a first-of-its-kind digital credit line offered by Mobikwik. It provides users with instant access to a predefined credit limit that can be used for a variety of financial transactions, both online and offline. Think of it as a virtual credit card without the plastic, offering users the flexibility to make purchases and payments seamlessly.

Key Features

- Instant Access to Credit: With Mobikwik Zip, you no longer need to go through the lengthy application process for traditional credit cards or loans. You can access a pre-approved credit limit instantly.

- Versatile Usage: Mobikwik Zip can be used for a wide range of transactions, including online shopping, bill payments, mobile recharges, travel bookings, and more.

- No Collateral Required: Unlike some traditional loans that require collateral, Mobikwik Zip is an unsecured credit line, meaning you don’t need to pledge any assets to access it.

- Interest-Free Period: Mobikwik Zip comes with an interest-free period, typically ranging from 15 to 45 days. During this period, you can make purchases and repay the borrowed amount without incurring interest charges.

- Flexible Repayment: You can repay the borrowed amount in easy monthly installments (EMIs) or as a lump sum, depending on your financial convenience.

- Hassle-Free Application: Applying for Mobikwik Zip is simple. Eligible users can activate it within the Mobikwik app with just a few clicks.

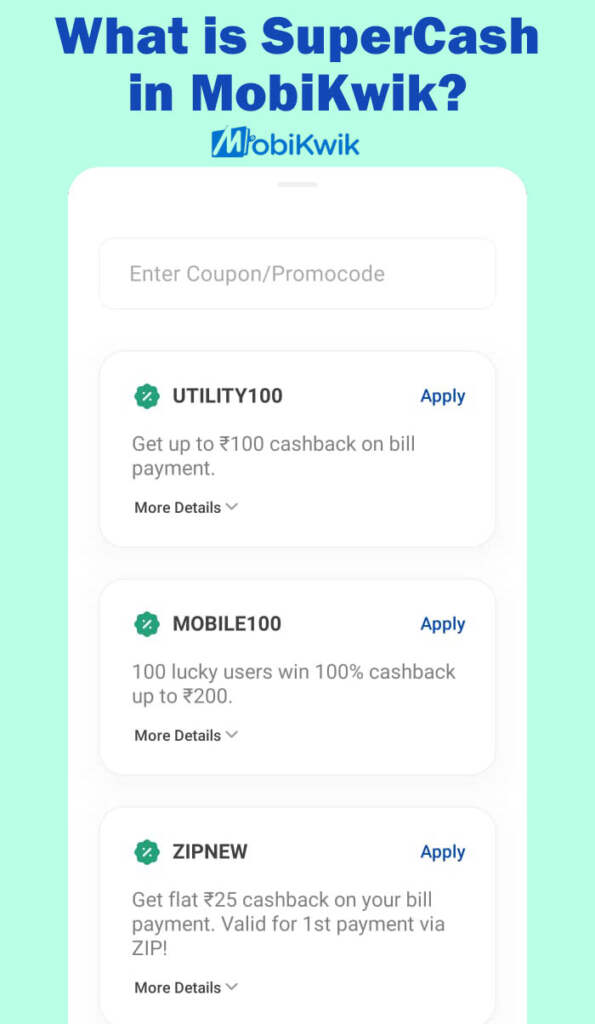

Mobikwik Referral Code

Download the Mobikwik App and Earn Cashback : Download Now

Try Mobikwik for credit card bill payments. It’s instant, seamless, and you can get Rs. 100 cashback on your first payment. You can also earn cashback rewards and access detailed spend analytics for better financial management. Give it a try!

How Mobikwik Zip Works

- Eligibility Check: Mobikwik assesses your eligibility for Mobikwik Zip based on your financial history, transactions, and creditworthiness. Eligible users receive an offer to activate Mobikwik Zip within the app.

- Activation: Once you receive the offer, you can activate Mobikwik Zip by verifying your identity and confirming your acceptance of the terms and conditions.

- Credit Limit: Mobikwik assigns you a pre-approved credit limit, which determines how much you can borrow using Mobikwik Zip.

- Transactions: You can start using Mobikwik Zip for various transactions, similar to how you would use a digital wallet or credit card.

- Interest-Free Period: During the interest-free period, you won’t incur any interest charges on the borrowed amount. It’s essentially an extension of credit with no added cost.

- Repayment: When the interest-free period ends, you’ll need to repay the borrowed amount. You can choose to pay it off as a lump sum or convert it into EMIs.

Benefits

- Convenience: Mobikwik Zip offers an easy and convenient way to access credit without the need for physical paperwork or collateral.

- Flexibility: You can use Mobikwik Zip for a wide range of transactions, making it a versatile financial tool.

- Interest-Free Period: The interest-free period allows you to manage your expenses without incurring interest charges, provided you repay within the stipulated time.

- No Hidden Fees: Mobikwik is transparent about its fees, ensuring that users are aware of any charges associated with Mobikwik Zip.

- Digital Accessibility: Mobikwik Zip is accessible through the Mobikwik app, making it easy to monitor and manage your credit line.

Related Articles

Conclusion

Mobikwik Zip is changing the way Indians access credit, providing a convenient and flexible financial tool that adapts to modern lifestyles. With its versatile usage, interest-free period, and hassle-free application process, Mobikwik Zip is an excellent option for those looking to manage their finances efficiently. However, users should exercise responsible financial behavior to ensure they make timely repayments and maximize the benefits of this innovative digital credit line. As the world of digital finance continues to evolve, solutions like Mobikwik Zip are making financial empowerment more accessible than ever.

FAQs – Frequently Asked Questions

1. What is Mobikwik ZIP?

Ans. Mobikwik ZIP is a digital credit line offered by Mobikwik, a leading digital wallet and financial services platform in India. It provides users with a predefined credit limit that can be used for various financial transactions.

2. How does Mobikwik ZIP work?

Ans. Mobikwik ZIP works by offering eligible users a pre-approved credit limit that they can access instantly. This credit can be used for a range of transactions, and users have the flexibility to repay the borrowed amount within an interest-free period.

3. Is Mobikwik ZIP similar to a traditional credit card?

Ans. Mobikwik ZIP shares some similarities with a traditional credit card, such as offering a credit limit and an interest-free period. However, Mobikwik ZIP is a digital credit line accessed through the Mobikwik app and does not involve a physical card.

4. What can I use Mobikwik ZIP for?

Ans. Mobikwik ZIP can be used for a variety of financial transactions, including online shopping, bill payments, mobile recharges, travel bookings, and more.

5. Is Mobikwik ZIP secured by collateral?

Ans. No, Mobikwik ZIP is an unsecured credit line, meaning users do not need to pledge any assets or collateral to access it.

6. Is there an interest-free period with Mobikwik ZIP?

Yes, Mobikwik ZIP typically comes with an interest-free period, ranging from 15 to 45 days. During this period, users can make purchases and repay the borrowed amount without incurring interest charges.

7. How can I check if I’m eligible for Mobikwik ZIP?

Eligibility for Mobikwik ZIP is assessed based on your financial history, transactions, and creditworthiness. If you are eligible, you will receive an offer within the Mobikwik app.

8. How do I activate Mobikwik ZIP?

To activate Mobikwik ZIP, simply follow the instructions provided in the offer within the Mobikwik app. This typically involves verifying your identity and accepting the terms and conditions.

9. Can I repay the borrowed amount in installments with Mobikwik ZIP?

Yes, you have the option to repay the borrowed amount in easy monthly installments (EMIs) or as a lump sum, depending on your financial convenience.

10. Are there any hidden fees associated with Mobikwik ZIP?

Mobikwik is transparent about its fees, and users are made aware of any charges associated with Mobikwik ZIP. It’s essential to review the terms and conditions to understand the fees and charges.

11. Is Mobikwik ZIP accessible through the Mobikwik app?

Yes, Mobikwik ZIP is accessible through the Mobikwik app, allowing users to monitor and manage their credit line conveniently.

12. Can I use Mobikwik ZIP for both online and offline transactions?

Yes, Mobikwik ZIP can be used for a wide range of transactions, including online and offline purchases, making it a versatile financial tool.

13. What happens if I don’t repay the borrowed amount within the interest-free period?

If you do not repay the borrowed amount within the interest-free period, you may incur interest charges on the outstanding balance. It’s important to adhere to the repayment terms to avoid additional costs.